Check Out Expert Financing Services for a Smooth Loaning Experience

In the realm of financial deals, the pursuit for a smooth borrowing experience is frequently demanded however not quickly achieved. Professional loan services offer a path to navigate the complexities of borrowing with accuracy and knowledge. By lining up with a credible lending company, people can unlock a plethora of advantages that extend past simple financial deals. From tailored lending options to tailored guidance, the world of professional loan services is a realm worth discovering for those seeking a loaning journey marked by effectiveness and ease.

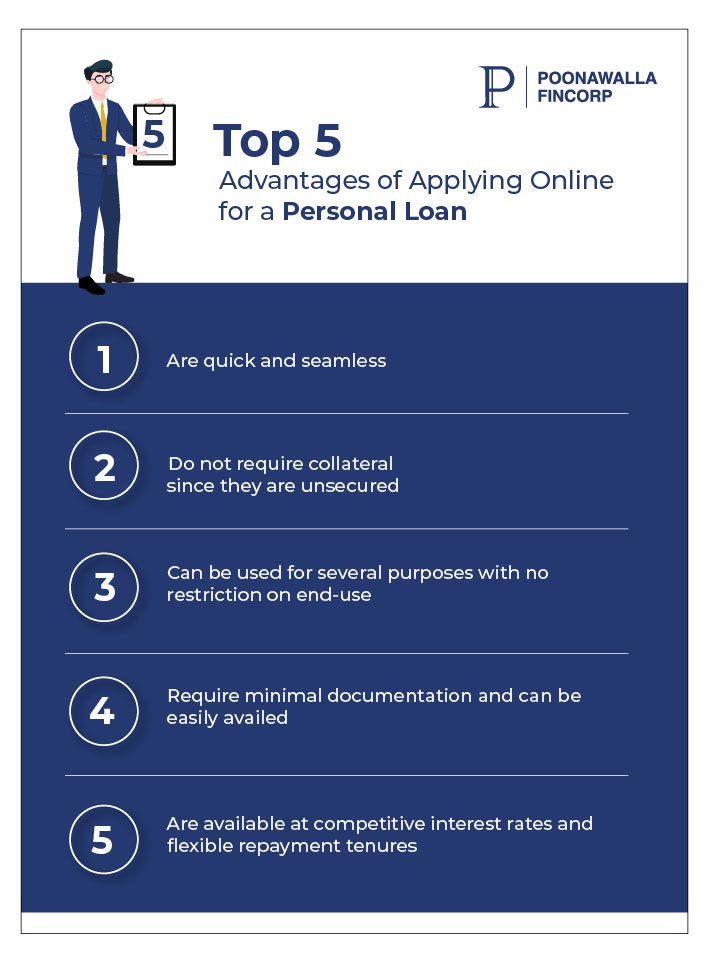

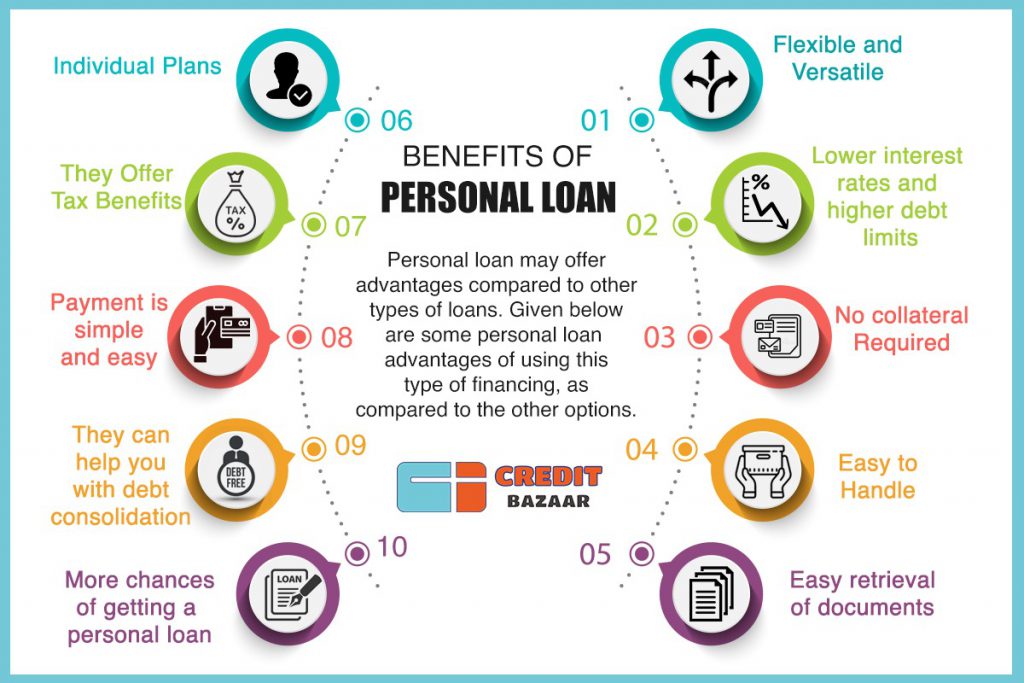

Benefits of Professional Car Loan Services

Specialist car loan services supply know-how in navigating the complex landscape of loaning, providing customized services to satisfy details financial demands. Expert loan services typically have actually established connections with loan providers, which can result in faster authorization procedures and far better negotiation outcomes for debtors.

Choosing the Right Lending Carrier

Having identified the benefits of specialist finance services, the next critical step is selecting the best lending carrier to satisfy your particular financial demands efficiently. mca funders. When choosing a lending provider, it is important to take into consideration numerous crucial aspects to make certain a smooth borrowing experience

Firstly, evaluate the online reputation and reputation of the financing supplier. Research customer testimonials, ratings, and endorsements to determine the satisfaction degrees of previous customers. A trusted funding company will have clear terms, outstanding client service, and a performance history of reliability.

Second of all, contrast the rate of interest, fees, and payment terms supplied by various funding carriers - best mca lenders. Try to find a company that uses competitive prices and flexible payment choices customized to your economic scenario

Additionally, consider the finance application process and authorization duration. Choose a carrier that provides a streamlined application procedure with quick authorization times to gain access to funds quickly.

Streamlining the Application Process

To enhance performance and convenience for applicants, the lending service provider has implemented a structured application process. One key attribute of this structured application process is the online platform that allows applicants to send their information electronically from the convenience of their own homes or workplaces.

Understanding Car Loan Terms and Conditions

With the structured application procedure in location to streamline and speed up the borrowing experience, the following essential step for applicants is getting an extensive understanding of the car loan terms and conditions. Comprehending the terms and conditions of a financing is vital to guarantee that borrowers are mindful of their obligations, rights, and the overall price of borrowing. By being knowledgeable regarding the funding terms and problems, consumers can make audio financial choices and navigate the borrowing procedure with confidence.

Making Best Use Of Lending Authorization Opportunities

Protecting approval for a funding necessitates a strategic approach and complete preparation on the part of the customer. Furthermore, lowering existing debt and avoiding taking check these guys out on brand-new financial obligation prior to using for a loan can show economic duty and improve the likelihood of approval.

Furthermore, preparing a comprehensive and sensible budget that lays out earnings, costs, and the recommended funding repayment plan can showcase to lenders that the debtor is capable of handling the added economic commitment (best merchant cash advance). Giving all required paperwork immediately and properly, such as evidence of revenue and employment history, can streamline the approval process and infuse confidence in the lender

Final Thought

To conclude, specialist lending solutions use different advantages such as expert assistance, customized car loan alternatives, and enhanced authorization opportunities. By picking the best finance service provider and recognizing the conditions, borrowers can streamline the application procedure and make sure a seamless borrowing experience (Loan Service). It is important to carefully think about all elements of a financing prior to dedicating to make sure monetary stability and effective repayment